March 13, 2024

3 min read

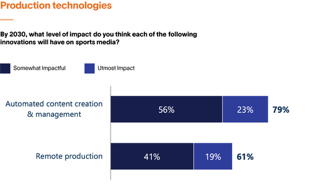

A 2023 global sports survey found the majority of sports executives believe that automated content production (79%) and remote production (61%) will have a significant impact on business. This article explores findings from the survey, including how new technologies and consumer habits will drive change in how the sports media industry produces and distributes content.

A new survey of sports executives shows that they expect new technologies and changing consumer habits to drive major changes in content production, particularly in the area of automated content production and remote production.

The latest installment of Altman Solon’s 2023 Global Sports Survey found that almost four out of five sports executives (79%) believe automated content creation will impact their business significantly, and that 61% believe remote production technology will be just as game-changing.

The survey of over 150 global sports executives and 2,500 consumers across eight countries spotlights how enabling technologies empower the value chain to generate greater fan engagement and unlock untapped revenue streams, the researchers said.

New technologies, including AI capabilities, virtual production tooling, and cloud-based workflows, will particularly transform content production and distribution in the sports media industry, the study found.

“Sports media innovation cycles are accelerating,” said Altman Solon director Matt Del Percio. “The media value chain is being disrupted by tech-driven top-down technology and user-driven, bottom-up consumption trends, and sports executives are aware of the huge business potential. To reap the benefits of these innovations, rights holders and sports media groups need to invest in a well-defined innovation roadmap that targets areas with long-term growth potential. In addition, testing new products and identifying interdependencies between different innovation areas will be crucial for successfully navigating the evolving landscape.”

In addition to the impact of content automation and remote technology, 74% cite impactful changes from content localization, like Virtual Board Replacement (VBR). These drive cost efficiencies that drastically streamline content workflows and generate monetization, the study explained. As media production and distribution workflows move to the cloud, rights holders and their media rights licensees will have greater opportunities to include localized highlight packages and acquire new, hyper-local advertisers with a fully tailored advertising inventory.

On the consumer side, respondents had a relatively cool response to the potential impact of AR/VR. Just over half (52%) of sports executives believe content augmentation (AR/VR, gamification, and advanced stats) will impact sports media.

This tepid response is partly due to low consumer adoption of mixed reality products. However, continued innovation in mixed realities and the launch of devices like Apple's Vision Pro headset signal emerging opportunities in the area, the researchers said.

Sports executives are even less bullish on blockchain and tokenization, with only 26% thinking that Web3 technologies and ownership models will move the needle. This is largely due to low fan adoption (only 6% surveyed have purchased a sports NFT or fan token). Nevertheless, executives believe that blockchain-based loyalty programs hold great promise in the future and have the potential to create synergies with gaming and live events, the report noted.

The study found that digital native sports fans are consuming content in new ways, ranging from ultra-personalized feeds and streaming subscriptions to Web3 fan communities. As the technology matures, blockchain-based loyalty programs could create a rich ecosystem connecting rights owners, fans, and partners, the researchers said.

The full report can be accessed here.

This article was written by George Winslow from TV Technology and was legally licensed through the DiveMarketplace by Industry Dive. Please direct all licensing questions to legal@industrydive.com.